Get a Quick Quote

Quick Quote

About Us

State Fund Insurance offers top insurance companies, carriers and agents. State Fund lets multiple companies and agents compete for your business, and we have the ability to give you multiple selections of insurance coverage and quotes. Not all insurance policies have the same coverage. Our agents and companies have the knowledge to help you with all your insurance needs. Also at State Fund, our automated systems help us to get you the right insurance quote and the right coverage for your needs.

We at State Fund are able to offer shoppers money and time saving options such as a wide range of insurance discounts and automatic withdrawal from your checking account. Insurance representatives can work with you electronically through e-mail, fax or phone to compete for your business.

Homeowners insurance is essential in protecting your valuable investment. It safeguards you from potential financial setbacks resulting from unforeseen events like fires, theft, and natural disasters. While shopping for a homeowners policy, you may come across the term 'deductible.' Let's delve into why choosing a higher deductible might be a smart decision for many homeowners. 1. What is a Deductible? A deductible is the amount of money you pay out-of-pocket for a covered loss before your insurance kicks in. For instance, if your home sustains $10,000 in damages and your deductible is $1,000, you'll pay the first $1,000, and State Fund Insurance will cover the remaining $9,000. 2. The Relationship between Deductible and Premium A crucial point to understand is the inverse relationship between the deductible and the premium. The premium is the amount you pay for your insurance policy, usually monthly or annually. Generally, the higher the deductible you choose, the lower your premium becomes. Conversely, a lower deductible often means a higher premium. 3. Why Consider a Higher Deductible? a. Reduced Premiums: As previously mentioned, a higher deductible can significantly lower your insurance premiums. Over time, these savings can add up, helping you manage your monthly expenses better. b. Fewer Claims: With a higher deductible, you're more likely to cover minor repairs and damages out-of-pocket instead of filing a claim. Fewer claims can mean better rates in the future, as insurance companies often increase premiums after claims. c. Prevents Small Claims: Several small claims can lead to higher insurance rates and even cancellation, or non renewal. By having a higher deductible, you're less likely to file a claim for minor damages, ensuring your rates remain stable. d. Builds Financial Discipline: Knowing you have a higher deductible might motivate you to set aside an emergency fund. This financial discipline is invaluable not just for potential insurance claims but for other unexpected expenses too. 4. Is a Higher Deductible Right for Everyone? While there are clear benefits to choosing a higher deductible, it's essential to evaluate your financial situation. Ensure you can comfortably afford the deductible amount in the event of a claim. If you're living paycheck-to-paycheck, a higher deductible might pose challenges. In Conclusion Taking a higher deductible on your homeowners policy can be a sound financial decision, contact State Fund Insurance for money saving options, especially if you're looking to reduce premiums. However, it's essential to choose a deductible that aligns with your financial capability. Consult with a State Fund Insurance agent to find the perfect balance that suits your needs.

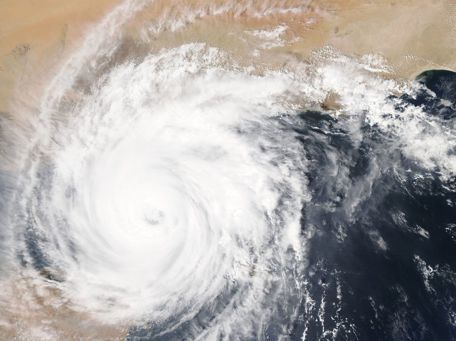

Increased Cost of Construction How old is your home? Any building more than a few years old might not comply with current building codes. And that can create problems. When property damage forces you to rebuild or remodel, you most likely will have to bring your construction up to current building codes. Most homeowners policies exclude coverage for loss due to complying with an ordinance or law regulating construction, repair or occupancy of any building. So even if your home is properly insured to value, your policy might not cover the additional costs of bringing it up to current codes. To make matters worse, after a portion of your home is damaged, local authorities can require you to repair undamaged portions to bring them up to current codes. And since remodeling usually costs more on a square-foot basis than new construction, these repairs can be costly. Debris Removal If your home is destroyed or damaged, you’ll probably have some trash and debris to remove before repairs can begin. Will your insurance policy cover these costs? The typical homeowners property policy provides debris removal coverage as an “additional coverage” over and above your property policy’s limits. It will pay the cost of removing “covered property” damaged by a “covered cause of loss.” Sometimes a policy will include an additional debris removal limit—check the policy declarations. If the total of the direct physical loss costs and debris removal costs exceeds your policy limits, or if debris removal expenses exceed the debris removal “additional coverage” limits, some policies will provide an additional cost in debris removal coverage per incident. This additional coverage often applies in areas where storm damage is common. ©2012 SmartsPro Marketing. tel. 877-762-7877 • www.smartspromarketing.com